Broken Trust

Steel. Railroads. Sugar. Oil. Tobacco. All these industries were monopolies during an earlier era. In 1890, the first major antitrust legislation was enacted to deal with public outcry over…price fixing. Accusations of companies charging more than a fair price. Hmmmmm. Doesn’t this sound more familiar and contemporary than 100-plus years ago?

If you know a Taylor Swift fan, a few Tuesdays ago was either the day of great celebration or mad frustration over her much-coveted concert tickets. After the ticketing debacle of 2022, many disappointed Millennials and Gen Zers quickly became antitrust law experts.

As this unfolded, here at the Foundation, we said, “We’ve been here before,” and the team went to work to dig up some records from our antitrust history. Yes, the Archives holds all of the records, and we are serving them up to you this week.

At the Archives, everyone gets a ticket to our shared history.

Patrick Madden

Executive Director

National Archives Foundation

The Last Great American Dynasty

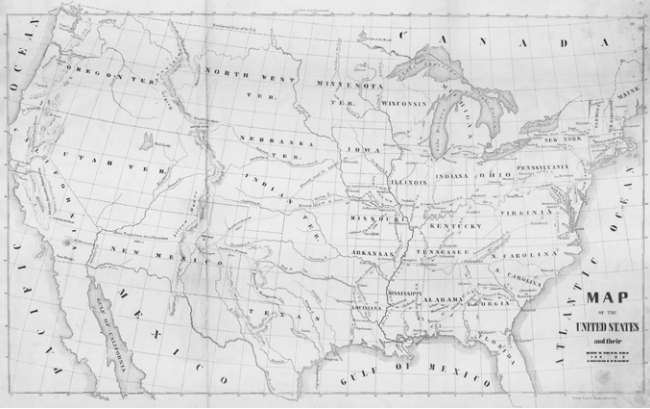

Monopoly: it’s not just a popular board game! It occurs when a single company controls an entire industry or the supply for an entire industry, and it’s a condition we’ve historically tried to avoid in the name of consumer welfare. But monopolies existed well before the rise of huge corporations or global conglomerates. As far back as colonial days, companies with the resources to make the “new world” habitable were granted exclusive contracts by colonial governors. It wasn’t always the government’s job to fight them!

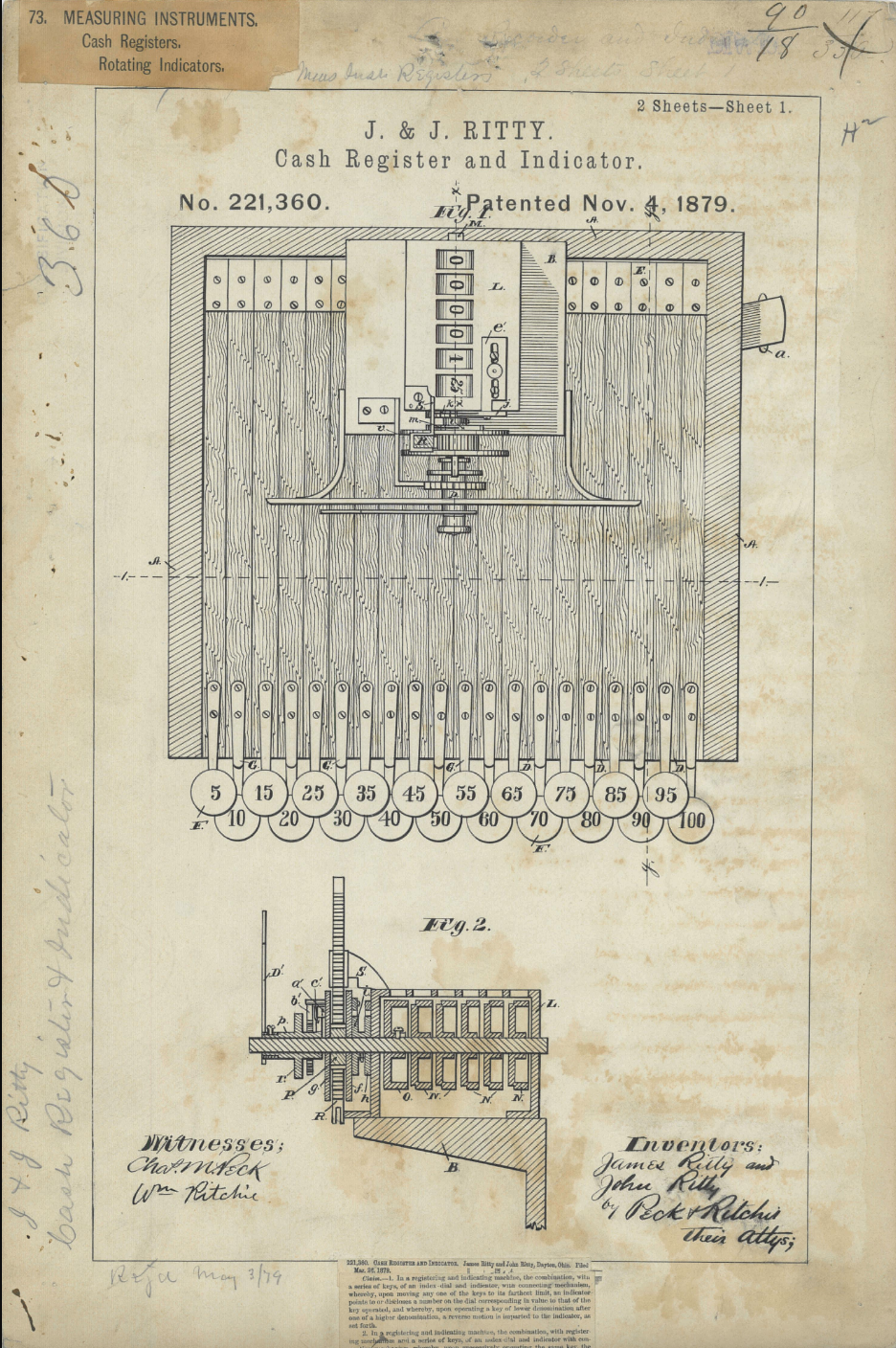

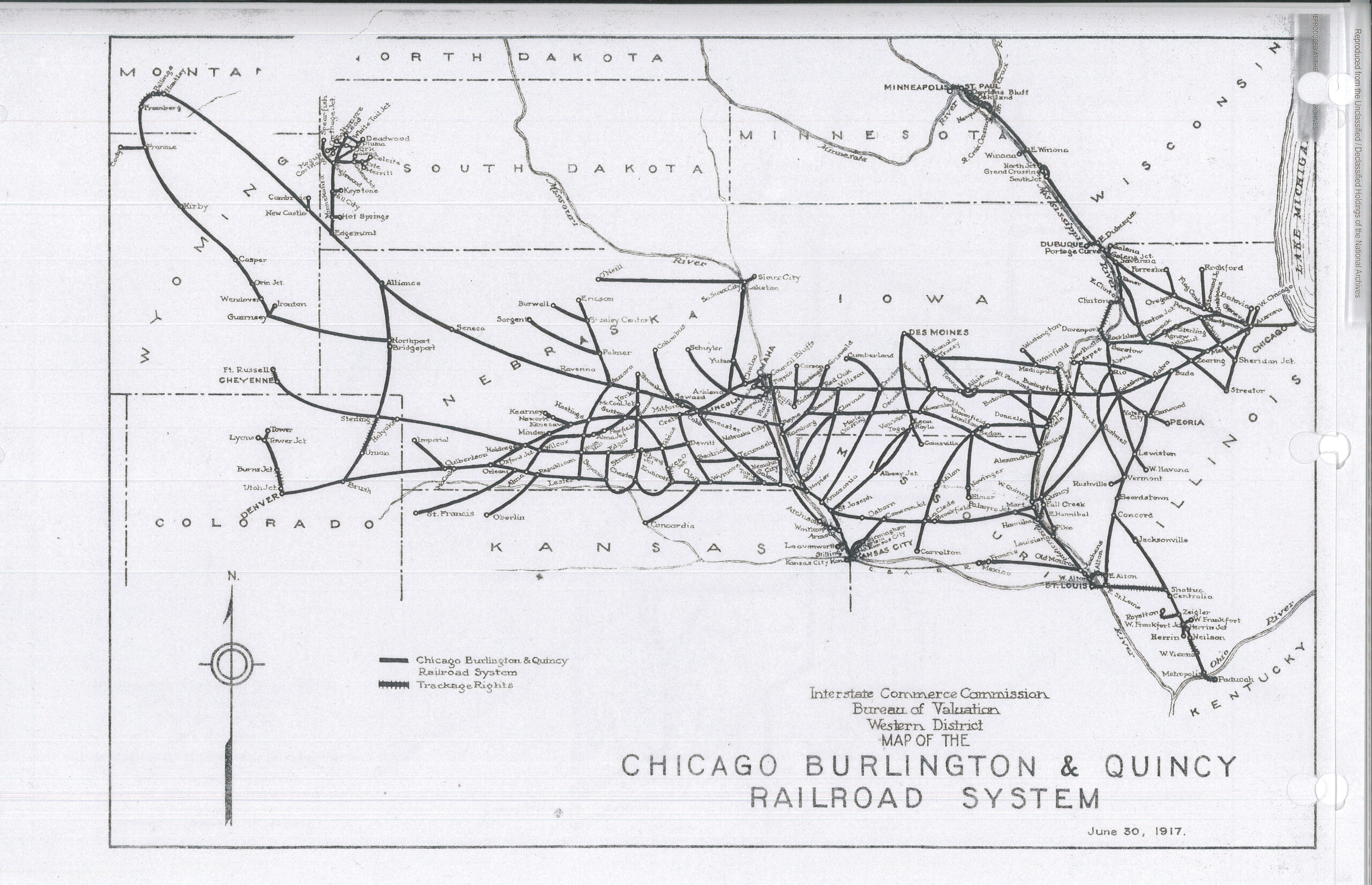

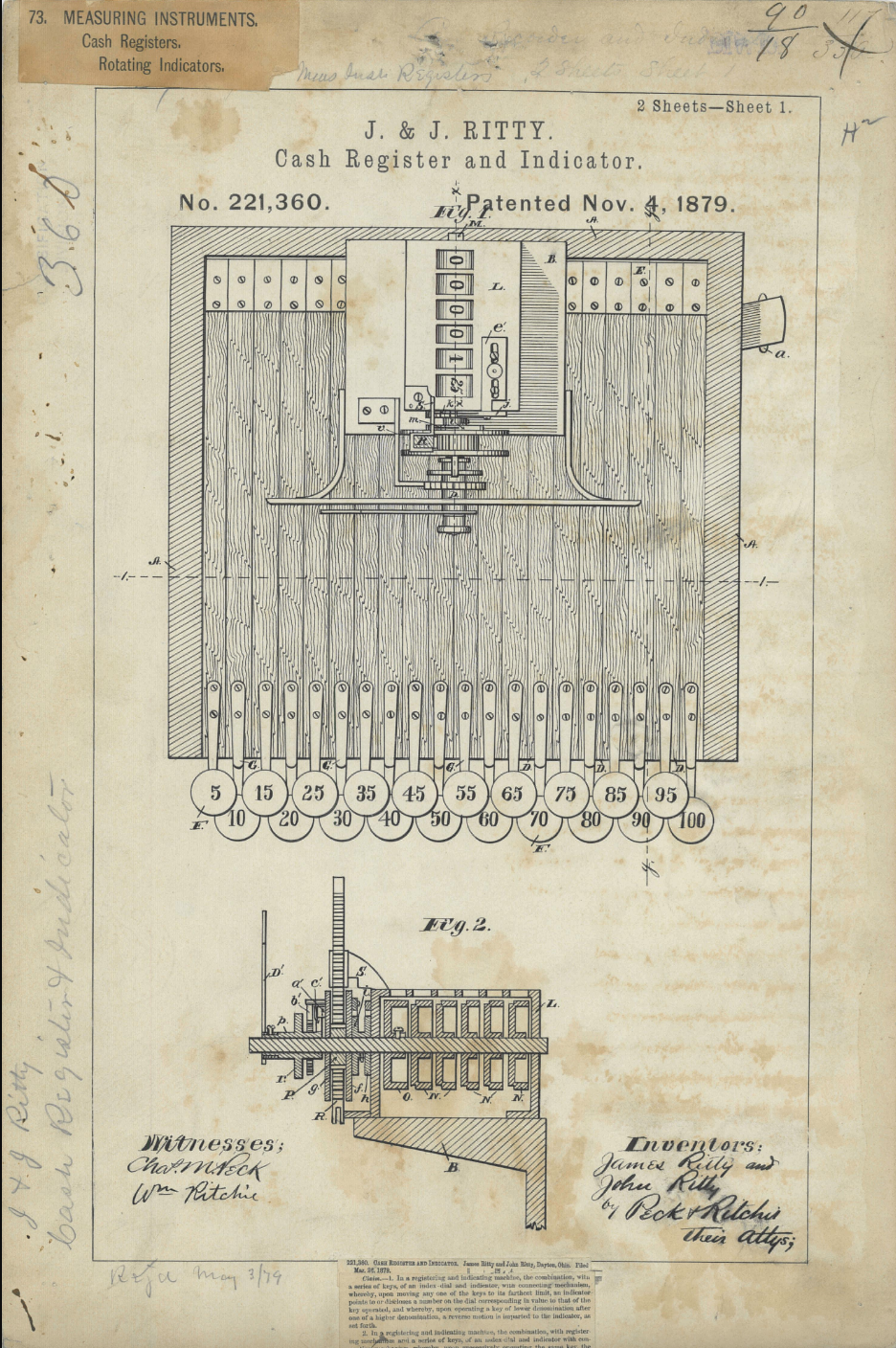

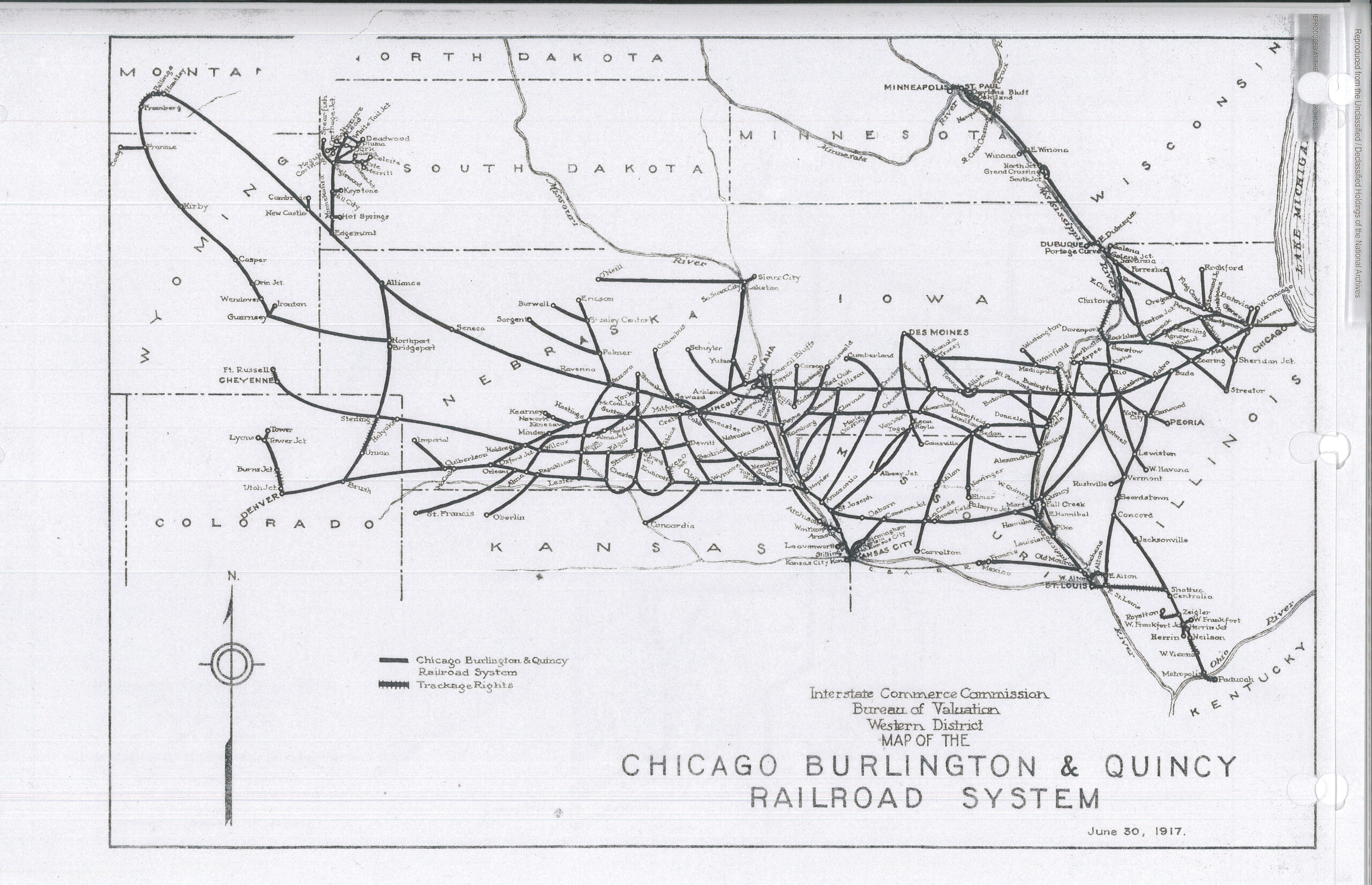

But that changed in the late 19th century, when the U.S. economy was growing at breakneck speed. The Industrial Revolution brought on rapid advances in technology and changed the way people did everyday work; it wasn’t just the coast-to-coast railroads and introduction of industrial farm equipment that made work more efficient, but also smaller scale improvements like the cash register, adding machine and typewriter. Immigration from Europe also massively expanded our workforce, and businesses were emboldened by the concept of laissez faire capitalism – meaning little to no government regulation of industry and commerce.

It’s at this time that some of the most famous names in business that we still recognize emerged: Rockefeller, who controlled the oil market, Vanderbilt, who owned almost every rail and steamship line in the nation, and Carnegie, whose steel empire made him millions. Their complete control of the markets and vast accumulation of wealth led American author Mark Twain to coin the term “Gilded Age” as an insult for the ostentatious displays of money in the face of mass inequality. (P.S. If you want a reminder of just how extravagant the Gilded Age was, check out a previous edition of our newsletter, “All That Glitters,” here.)

The stranglehold these men had over the American economy earned them the nickname of “Robber Barons.” Not only was this term associated with enormous wealth, but also with political corruption, bribery and the exploitation of workers. It wasn’t long before the public, and even other businessmen, began protesting the Robber Barons. Investigative journalists like Nellie Bly shed light on the practices of the Robber Barons, which eventually led to consequences.

Karma

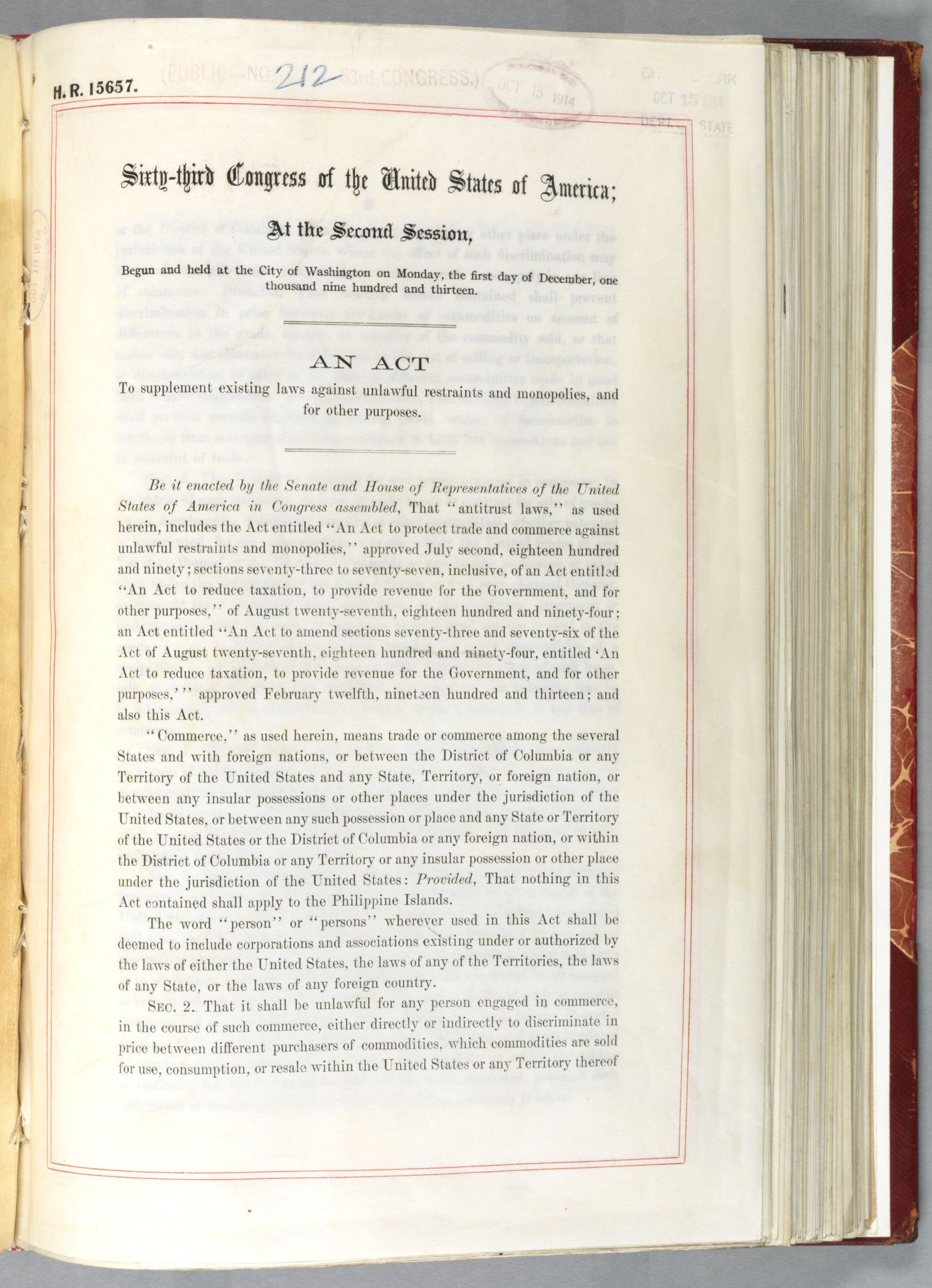

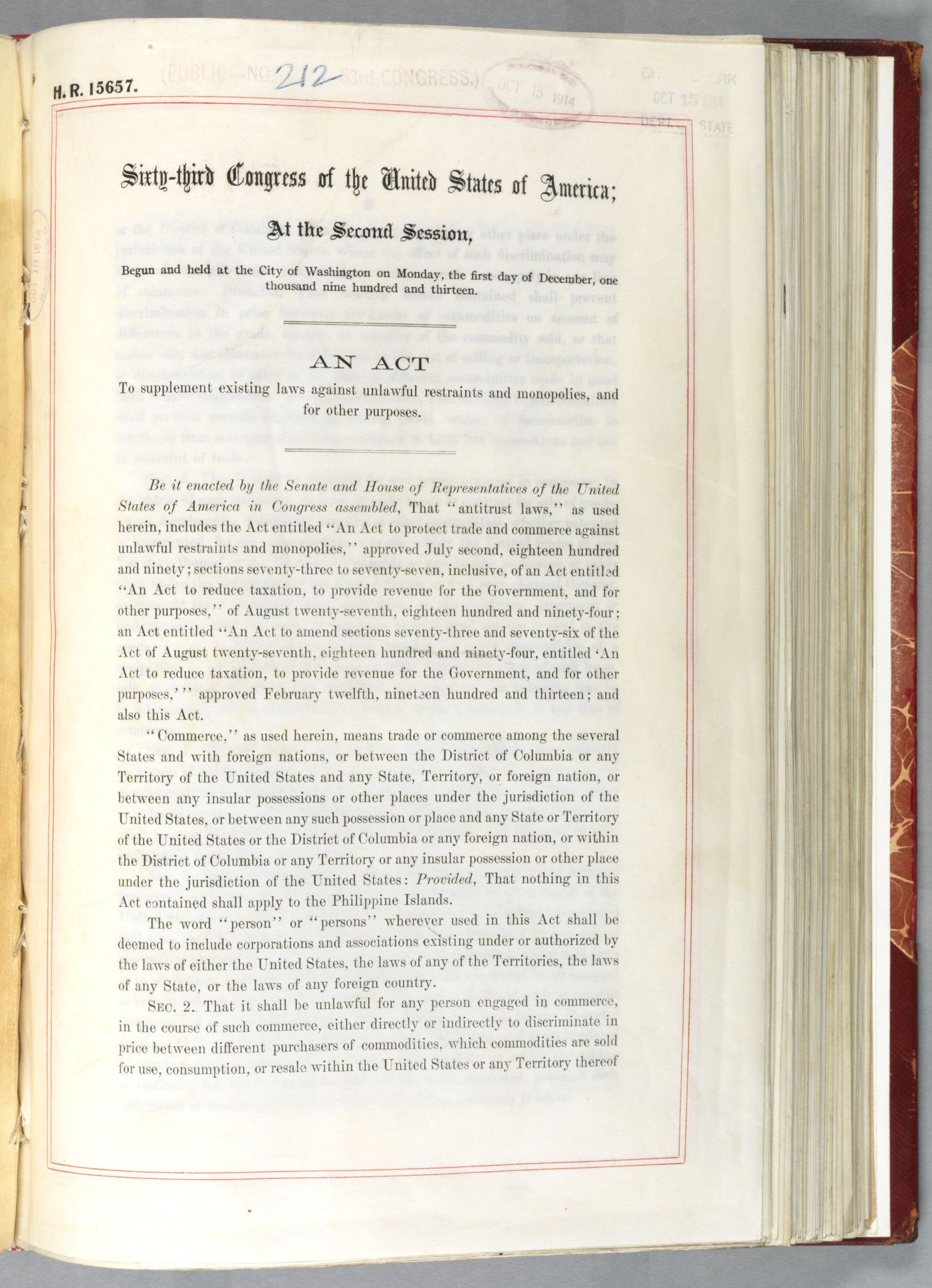

The three laws that govern trusts and monopolies in the United States are the Sherman Act of 1890 and the Federal Trade Commission Act and the Clayton Act, both passed in 1914. The Sherman Act was the nation’s first effort to rein in the monster monopolies of the 19th century, especially John D. Rockefeller’s Standard Oil, Andrew Carnegie’s Carnegie Steel Company and Cornelius Vanderbilt’s railroad and steamship empire. It criminalizes “every contract, combination, or conspiracy in restraint of trade,” and any “monopolization, attempted monopolization, or conspiracy or combination to monopolize.” This is an important distinction – although prosecutions under the Sherman Act can be undertaken in civil court, the act is also a criminal act, and the penalties it can impose are severe. A corporation can be fined up to $100 million and an individual up to $1 million, and prison sentences can top out at 10 years. Furthermore, the maximum fine can be double what the conspirators gained from the illegal acts or twice what the victims of the crime lost if either of those amounts is over $100 million. All that being said, the courts have often ruled that every restraint of trade is not a violation of the Sherman Act, only “unreasonable” restraints of trade.

The Federal Trade Commission Act established the Federal Trade Commission (FTC) to oversee trade within the United States. It outlaws “unfair methods of competition” and “unfair or deceptive acts or practices.” The U.S. Supreme Court has ruled that anything that violates the Sherman Act also violates the Federal Trade Commission Act, but the latter act also covers other competitive acts that don’t fall within the Sherman Act’s purview. The FTC is the only federal body that can bring charges under the Federal Trade Commission Act. Its building in Washington, D.C. opened in 1938, and FDR delivered a speech a year prior at its cornerstone-laying ceremony on July 12, 1937. At the opening of his speech, he referred to the work of the commission, especially in terms of the Great Depression, saying, “An ounce of prevention is worth a pound of cure.”

The Clayton Act fills in some of the gaps in the Sherman Act by dealing with mergers and acquisitions in which the effect “may be substantially to lessen competition, or to tend to create a monopoly.” It was amended by the Robinson-Patman Act of 1936 to block merchants from indulging in certain discriminatory practices and again in 1976 by the Hart-Scott-Rodino Antitrust Improvements Act, which obliges companies that are planning large mergers or acquisitions to notify the government of their plans in advance. Under the Clayton Act, private parties can sue for triple damages if they have been harmed by actions that violate either the Sherman or Clayton Act and can obtain a court order prohibiting future anticompetitive practices.

The Man

The Square Deal Club

National Archives Identifier: 6010554

Theodore Roosevelt became the 26th president of the United States when his predecessor, William McKinley, was assassinated. Roosevelt was only 42 then, the youngest man to hold the office, and a man born into a life of great privilege. That said, his family had long been dedicated to both business and philanthropy. His father, Theodore Roosevelt, Sr., successfully ran the family glass-importing business, but he was also very active in New York City’s Children’s Aid Society, the Metropolitan Museum of Art, the American Museum of Natural History, the Children’s Orthopedic Hospital, the Newsboys’ Lodging House and the YMCA.

Because his wife’s family was prominent in Confederate circles, Theodore Roosevelt, Sr., did not enlist in the Union Army, but he and a group of friends worked out a system whereby Union soldiers could have a portion of their pay sent to their families back home, and Theodore, Sr., lobbied Washington, including Abraham Lincoln, to gain approval for the plan. He then personally helped set it up in the field in the early days of the war. Theodore, Jr., thus grew up with the expectation that he too would find ways to pay his good fortune forward.

When Teddy became president in 1901, the Sherman Act, which was the first federal act governing monopolies and trusts in the country, had already been law since 1890, but the courts had routinely sided with big business whenever companies were charged with restraint of trade. Believing that “bad trusts” and unrelenting greed would soon result in a violent uprising by the working poor in America, Teddy Roosevelt made it his mission to break up the trusts and bring down costs.

The Square Deal Discusses the High Cost of Living

National Archives Identifier: 6011199

He first took on the Northern Securities Company, owned by J. Pierpont Morgan, which controlled most of the railroad shipping across the northern U.S. Informed that he was being sued during dinner at his home in New York one evening in 1902, Morgan was stunned that Roosevelt had the gall to take him to court over his unscrupulous ways, but sue him Teddy did. Morgan was even more astounded when Roosevelt was victorious – in a narrow vote, 5-4, the Supreme Court dissolved the Northern Securities Company. It was the first of 44 antitrust suits that the Roosevelt administration filed. Teddy also achieved the regulation of Standard Oil, John D. Rockefeller’s massive oil monopoly.

Although Teddy Roosevelt was often called a “trust buster,” he actually considered big business part of the American landscape. He only went after trusts he considered “bad trusts,” that is to say, those operations that cornered markets, charged their customers exorbitant prices, underpaid their own employees and generally mistreated other people for their own benefit.

Mastermind

Who is this businessman? A few hints:

- he used his fortune from his father’s mining company to support political candidates;

- he owned and controlled a huge communications platform;

- he was known for his sensational headlines; and

- his political views moved from leftist Democrat to conservative isolationist over time.

This all sounds familiar, so did you guess right? It’s none other than William Randolph Hearst! Hearst developed the nation’s largest newspaper chain and media company, Hearst Communications. If you’ve heard of “yellow journalist,” it started with him. One way he got people to buy newspapers was creating sensational headlines – historic “click bait,” if you will.

Hearst’s wealth and power show that monopoly doesn’t just apply to what products you buy. It can also be from who and where you get news and information.

Look What You Made Me Do

1998 press conference statement on Microsoft case

National Archives Identifier: 179032162

Lest you think trust-busting is a thing of the past, think again. Many of the big tech companies have been the subjects of antitrust investigations and even lawsuits over the past several decades as the U.S. Department of Justice (DOJ) has tried to determine whether the tech giants have used unethical business practices to restrain trade and corner markets.

As just one example, the Federal Trade Commission (FTC) and the DOJ investigated Microsoft in the early 1990s because they suspected the company of using its licensing agreements to guarantee the dominance of the Windows operating system. Microsoft avoided litigation that time by entering a consent decree in 1994 to not require computer manufacturers to buy Microsoft products when they bought other Microsoft licenses, but soon thereafter, Microsoft started bundling its Internet Explorer (IE) with Windows 95. Removing IE from Windows 95 was almost impossible, so purchasers were pretty much stuck with it.

In 1998, the DOJ sued Microsoft, stating that the company was forcing purchasers of Windows 95 to use IE. Microsoft insisted that IE wasn’t a separate program, but the company lost the suit. Microsoft was ordered to break into two companies, one for the operating system and one for all its other products. Microsoft appealed, and the ruling was overturned. Finally, in 2002, the DOJ and Microsoft settled the lawsuit. Microsoft didn’t have to break up, but it did have to make it easier for purchasers to use third-party software with Windows. The company also had to agree to government supervision and pay billions in fines.

Currently, the federal government is reportedly investigating pursuing antitrust actions against Google, Apple, Amazon and Facebook as well.